Creating Stability With Unsteady Business Revenue

Nobody really warns you about the emotional rollercoaster that comes with unpredictable income. One day you're invoicing three clients and feeling like you've got this whole entrepreneurship thing figured out. The next day, you're staring at your bank account at 2 AM, wondering if that late payment will come through before your rent is due.

If you're running a small service business or freelancing, you know this feeling intimately. It's that weird mix of pride in your independence and panic about next month's bills. The freedom of being your own boss comes with the responsibility of being your own financial safety net, and that can feel pretty heavy sometimes.

The good news? You're not alone in feeling this way, and there are real strategies that can help smooth out the bumps. Let's talk about how to create some stability when your income feels anything but stable.

Related Podcast: Episode 32: Creating Stability When Revenue is Unsteady

The Reality of Unsteady Revenue

Sarah runs a small cleaning service and describes her first year like this: "I'd go from having five clients one week to one client the next. I never knew if I should celebrate a good week or save every penny for the dry spell I knew was coming." This unpredictability isn't just about the numbers, it messes with your head.

The stress of irregular income affects everything from your sleep to your relationships. You might find yourself checking your email obsessively for payment confirmations or avoiding spending money on anything that isn't absolutely essential. Some business owners even report feeling guilty about taking time off because every hour not working feels like money lost.

But here's what experienced entrepreneurs will tell you: this anxiety doesn't completely go away, but you definitely get better at managing it. The key is building systems and habits that create islands of stability in the chaos.

Building Your Financial Cushion

The most important step toward stability is creating a buffer between you and financial disaster. Yeah, easier said than done when money is tight, but even small steps matter.

Start by tracking everything for a month. Write down every dollar that comes in and every dollar that goes out. Not just business expenses, everything. Your morning coffee, your Netflix subscription, that random Amazon purchase you forgot about. This isn't about judging your spending; it's about understanding your patterns.

Once you know your baseline, you can start building what freelancers call a "feast or famine fund." Even if you can only set aside $50 a week during good weeks, that adds up. The goal is eventually having three to six months of basic expenses covered. That might sound impossible right now, but remember: you're not trying to get there overnight.

Mike, who runs a small landscaping business, puts it this way: "I started putting away 20% of every payment that came in during my busy season. Some months I could only save $200, other months it was $800. But after two years, I had enough saved that a slow month didn't send me into panic mode."

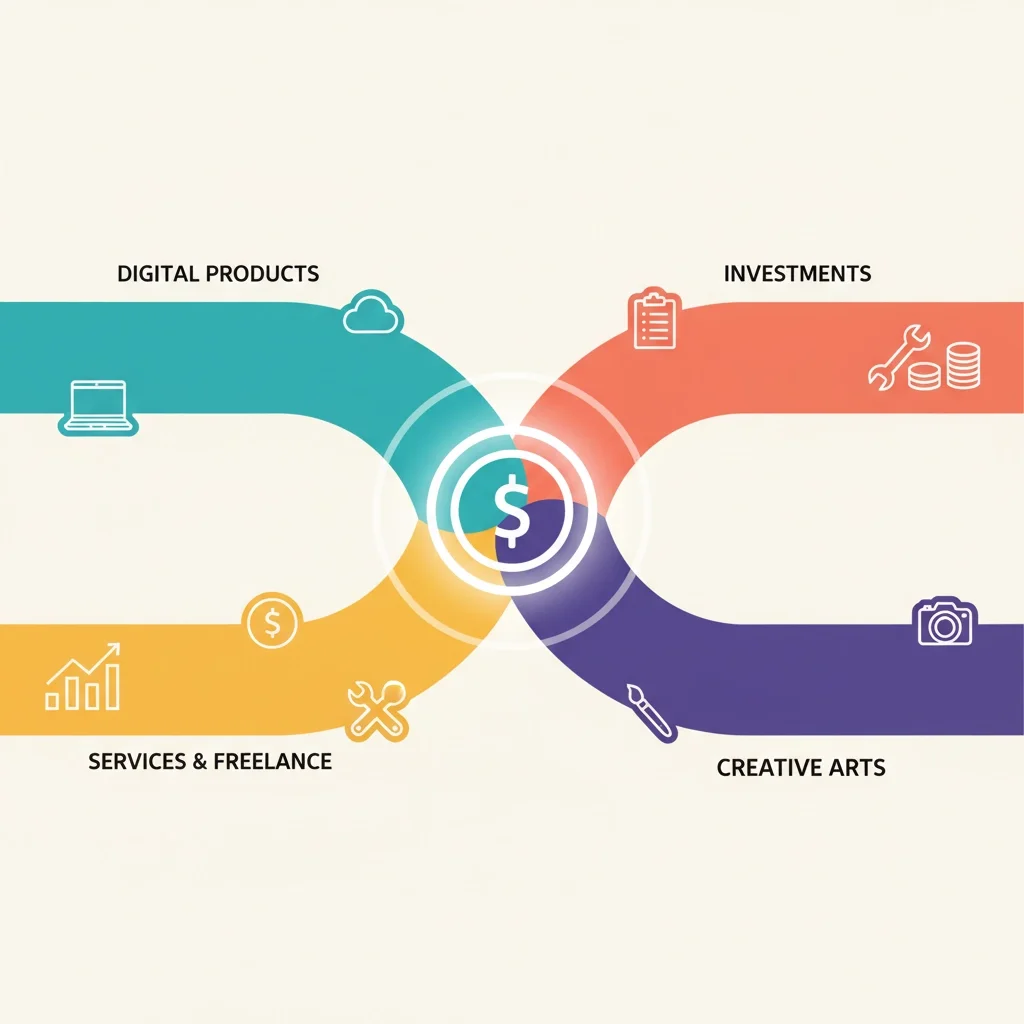

Diversifying Your Income Streams

Relying on one type of client or one service is like putting all your eggs in one very wobbly basket. The goal isn't to completely reinvent your business, but to add stability through variety.

Look at what you're already doing and ask: "How can I make this more predictable?" If you're a freelance writer who gets paid per project, could you pitch some clients on retainer agreements? If you run a seasonal business, what complementary services could you offer during slow months?

Take Tom's handyman business. He noticed he was super busy in spring and summer but practically idle in winter. Instead of just accepting the seasonal lull, he started offering indoor services like painting and small repairs during the off-season. Now his income is much steadier year-round.

The key is building on what you already know rather than starting from scratch. Your existing skills and client relationships are your biggest assets, use them to create multiple revenue streams that complement each other.

Managing Client Concentration Risk

Here's a mistake that can kill your stability: becoming too dependent on one or two major clients. It feels great when you land that big account that covers most of your expenses, but what happens when they decide to cut costs or go with someone else?

The general rule is to keep any single client under 20-25% of your total revenue. If you're at 50% or more from one client, you're essentially an employee disguised as a business owner. You need to actively diversify.

This means sometimes saying no to taking on more work from your biggest client and instead focusing on finding new ones. It feels counterintuitive, turning down guaranteed money, but it's essential for long-term stability. As covered in our guide on risky client lessons, putting all your eggs in one client basket rarely ends well.

Tracking and Monitoring Your Progress

You can't manage what you don't measure, and with irregular income, tracking becomes even more critical. But we're not talking about complex spreadsheets or expensive software, just consistent, simple monitoring.

Create a basic system that tracks:

Monthly income and expenses

Which clients pay on time vs. late

Seasonal patterns in your business

Your emergency fund growth

Many successful small business owners use the "traffic light" system: green months where income exceeds expenses by 20% or more, yellow months where you break even, and red months where you dip into savings. The goal is having more green months than red ones over time.

Lisa, who runs a social media consulting business, checks her numbers every Sunday: "It takes maybe 20 minutes, but it keeps me from that Sunday night anxiety spiral about whether I'm doing okay financially. When I see the trends laid out, I can make better decisions about taking on new projects or cutting expenses."

Developing Long-Term Habits

Stability comes from systems, not just good months. The entrepreneurs who weather financial uncertainty best have developed habits that serve them regardless of current income levels.

Separate business and personal finances completely. Pay yourself a consistent "salary" even when income varies. During good months, the extra stays in the business account. During tough months, you still get your regular pay from the business buffer you've built.

Celebrate small wins consistently. When you're living with financial uncertainty, it's easy to dismiss progress because you're always worried about the next challenge. Make it a habit to acknowledge positive trends, client wins, and financial milestones, no matter how small.

Build systems for everything. As discussed in our post on accountability without micromanagement, having clear processes reduces stress and improves consistency. This applies to your financial management too.

Mindset Shifts That Actually Help

The psychological aspect of irregular income is real, and pretending it isn't doesn't make it go away. But there are mindset shifts that can help you cope better with the uncertainty.

Start thinking in quarters, not months. Instead of panicking about a slow month, look at three-month periods. This smooths out the peaks and valleys and gives you a more realistic picture of your business health.

Reframe uncertainty as flexibility. Yes, not knowing exactly what next month will bring is stressful. But it also means you can pivot quickly, take advantage of unexpected opportunities, and adapt to changes that would derail traditional employees.

Focus on what you can control. You can't control when clients pay late or when the economy hits a rough patch. But you can control your response, your preparation, and your systems. As we explore in avoiding burnout while staying consistent, focusing on controllable factors reduces anxiety and improves outcomes.

Making Peace with the Rollercoaster

Here's the truth experienced entrepreneurs eventually learn: you don't completely eliminate the stress of unpredictable income. But you do get better at riding the waves instead of being knocked over by them.

The combination of practical systems: emergency funds, diversified income, consistent tracking: and realistic mindset shifts creates a foundation that can handle volatility. You stop checking your bank account obsessively because you know you have a buffer. You stop panicking about slow periods because you know they're temporary and you're prepared.

Most importantly, you start making decisions from a place of stability rather than desperation. When you're not constantly worried about next month's rent, you can focus on building the kind of business that serves you long-term instead of just surviving until the next payment arrives.

The unpredictability never completely goes away, but your ability to handle it grows stronger. And that makes all the difference between just surviving as an entrepreneur and actually thriving.