How to Save Money When Revenue Is Down: Stop Overpaying Hours

When revenue drops, every dollar counts. Yet most small businesses are unknowingly hemorrhaging money through one of their biggest expenses: labor costs. The problem isn't just obvious overtime: it's the hidden overpayments happening every single day.

A Deloitte study found that companies average 31 unplanned overtime hours each week. For a small business paying $15/hour regular time, that's $697.50 in unexpected overtime costs weekly, or over $36,000 annually. When margins are already tight, these surprise expenses can be the difference between staying afloat and going under.

The good news? Most overpayments are completely preventable with the right systems and processes.

Where Your Money Is Disappearing: Common Overpayment Problems

Manual Timesheet Rounding Errors

Paper timesheets are notorious for "friendly rounding." An employee who arrives at 8:03 AM writes down 8:00 AM. Another who leaves at 5:28 PM records 5:30 PM. These seem like small adjustments, but they add up fast.

Consider this scenario: You have 10 employees who each round up their time by just 15 minutes daily. At $15/hour, that's $18.75 per day in overpayments, or $4,875 annually. Scale this to 25 employees, and you're looking at over $12,000 in unnecessary costs.

Missed Punch Corrections

When employees forget to clock out, supervisors typically estimate their departure time. These estimates are rarely conservative. A manager might assume an employee worked until 6:00 PM when they actually left at 5:45 PM. Multiply these small overestimates across multiple employees and pay periods, and the costs compound quickly.

Time Padding and "Buddy Punching"

Some employees pad their hours by arriving early or staying late without productive work. Others participate in "buddy punching," where coworkers clock each other in or out to cover tardiness or early departures. Without proper monitoring, these practices can inflate your labor costs by 5-10%.

Inaccurate Break and Lunch Tracking

Manual systems often fail to properly track break times. Employees might clock out for a 30-minute lunch but return after 45 minutes, with the difference going unnoticed. Or they might forget to clock out for breaks entirely, getting paid for non-working time.

Immediate Solutions to Stop Overpaying

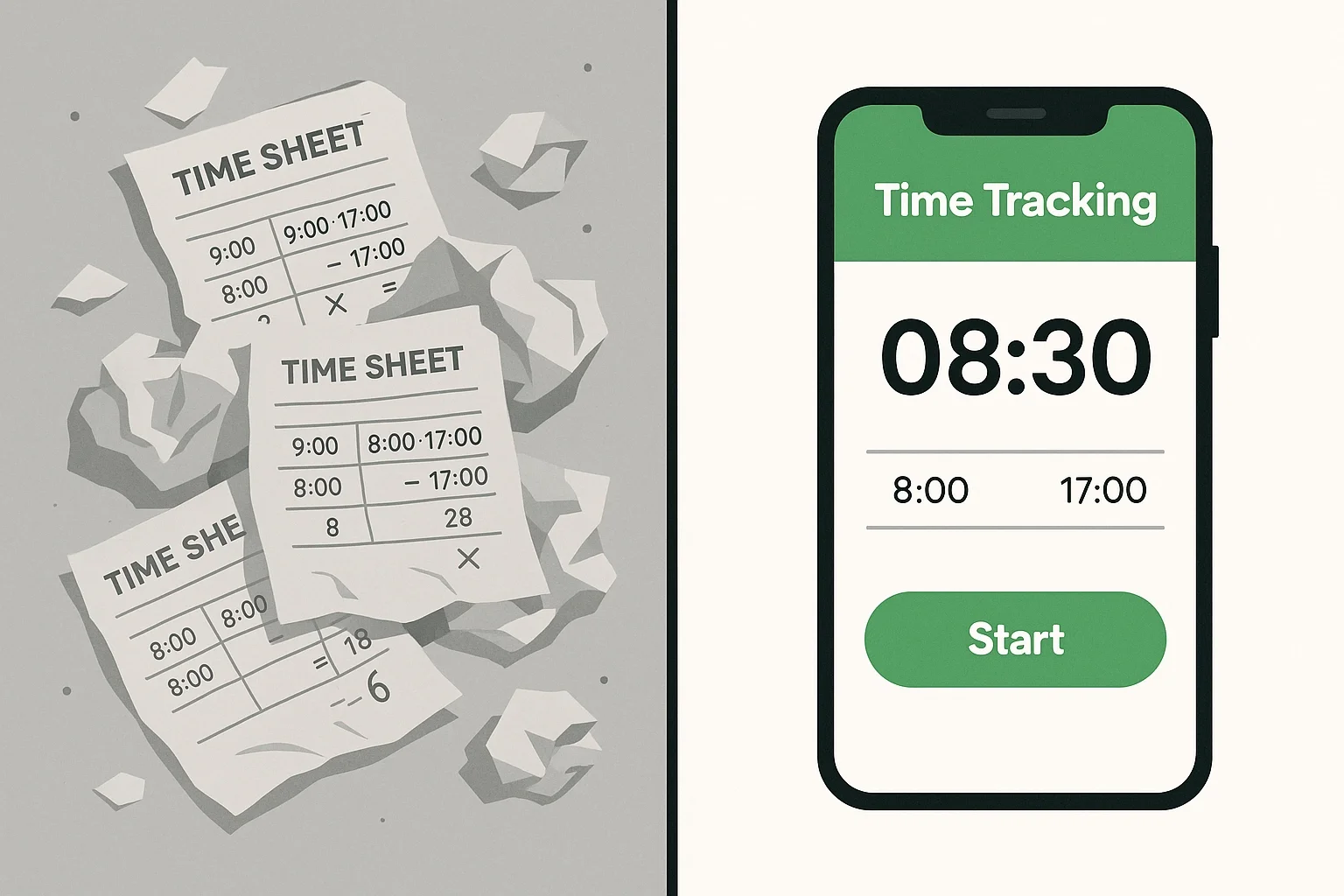

Implement Digital Time Tracking

The fastest way to eliminate overpayments is switching from manual to digital time tracking. Modern systems capture exact punch times down to the minute, eliminating rounding errors and guesswork.

Digital systems also prevent buddy punching through GPS verification and photo requirements. When employees must take a selfie and be at the correct location to clock in, fraudulent punches become virtually impossible.

Set Up Automated Overtime Alerts

Configure your time tracking system to send immediate alerts when employees approach overtime thresholds. This gives you real-time visibility to make adjustments before expensive overtime kicks in.

For example, if an employee hits 38 hours by Thursday, you'll get an alert allowing you to redistribute Friday's work to other team members or adjust schedules to avoid the time-and-a-half premium.

Use Clock Lockout Features

Prevent employees from clocking in early or staying late without authorization by implementing clock lockout windows. Set the system to only allow punches within 5-10 minutes of scheduled start times, and require manager approval for any exceptions.

This single feature can eliminate most unauthorized overtime and early arrivals that inflate your labor costs.

Calculating Your Savings Potential

Let's look at a realistic example. ABC Landscaping has 15 employees averaging $18/hour. Before implementing accurate time tracking, they experienced:

20 minutes of daily rounding per employee

3 missed punches weekly requiring estimates

2 hours of unauthorized overtime weekly

Monthly overpayments:

Rounding: 15 employees × 20 minutes × 22 days × $18/hour = $1,980

Missed punches: 3 × 15 minutes × 4 weeks × $18/hour = $54

Unauthorized overtime: 2 hours × $27/hour × 4 weeks = $216

Total monthly overpayment: $2,250

Annual overpayment: $27,000

After switching to digital time tracking, ABC eliminated 90% of these overpayments, saving approximately $24,300 annually. The time tracking system cost them $150/month, resulting in net savings of $22,500.

Beyond Time Tracking: Additional Cost-Cutting Strategies

Optimize Your Schedule

Use scheduling software to ensure you're not overstaffing during slow periods. Real-time labor budget tracking shows exactly how much you're spending as you build schedules, helping prevent cost overruns before they happen.

Cross-Train Employees

Having versatile employees reduces the need for overtime when someone calls out sick. Instead of paying time-and-a-half to cover a shift, you can reassign a cross-trained employee from a less critical task.

Review Your Break Policies

Ensure your break policies align with actual needs and local regulations. Some businesses discover they're providing more paid break time than required, creating opportunities for minor adjustments that add up to significant savings.

Implement Performance-Based Incentives

Rather than paying overtime for extra productivity, consider performance bonuses tied to completing work within scheduled hours. This approach can actually reduce total labor costs while maintaining output levels.

Technology Solutions That Pay for Themselves

Modern time tracking systems like Labor Sync offer features specifically designed to reduce overpayments:

GPS verification ensures employees are at job sites when clocking in

Photo requirements prevent buddy punching

Automatic break deductions ensure compliance with labor policies

Real-time overtime tracking provides immediate cost visibility

Manager alerts flag unusual punch patterns or potential issues

The ROI on these systems is typically measured in weeks, not months. For most small businesses, the monthly software cost is recovered through eliminated overpayments in the first pay period.

Implementation: Your Step-by-Step Action Plan

Week 1: Audit Your Current System

Calculate your baseline by reviewing timesheets from the past three months. Look for patterns in rounding, frequent overtime, and missing punches. This establishes your savings potential and provides a benchmark for measuring improvement.

Week 2: Choose Your Solution

Research time tracking options that fit your business size and industry. Consider factors like GPS requirements, offline functionality, and integration with your payroll system. Many solutions offer free trials, allowing you to test functionality before committing.

Week 3: Employee Training and Rollout

Introduce the new system gradually. Start with a pilot group of 3-5 employees to identify any issues before full deployment. Provide clear training on proper punch procedures and explain how accurate time tracking benefits everyone.

Week 4: Monitor and Adjust

Track your results closely during the first month. Compare labor costs to your baseline and identify any remaining problem areas. Most businesses see immediate improvement, with full benefits realized within 30-60 days.

Making the Business Case for Change

When presenting time tracking solutions to stakeholders, focus on concrete numbers. Calculate your annual overpayment estimate and compare it to the software cost. For most small businesses, the payback period is 1-3 months.

Remember to frame this as operational efficiency, not employee surveillance. Accurate time tracking protects honest employees from suspicion while ensuring fair compensation for actual hours worked. It's about creating accountability and transparency, not micromanagement.

Managing multiple job sites becomes much easier when you have reliable data on where employees are and what they're working on.

Preparing for Long-Term Success

Cost control isn't a one-time fix: it requires ongoing attention. Establish monthly reviews of labor costs and time tracking data to identify new trends or issues. As your business grows, your systems should scale with you.

Consider the broader impact of accurate time tracking on your business operations. Better data leads to improved project estimates, more accurate billing, and stronger client relationships. The cost savings are just the beginning.

Small businesses that master time and labor management position themselves for sustainable growth, even during challenging economic periods.

When revenue is down, stopping overpayment for hours isn't just smart business: it's essential survival strategy. The question isn't whether you can afford to implement better time tracking, but whether you can afford not to.

Ready to stop overpaying for hours and start saving money immediately? Try Labor Sync free for 14 days and see exactly how much you could be saving with accurate time tracking.